How Much Redistribution is Enough?

IBDEditorials.com

Income Gap: As President Obama laments

America's growing income inequality, a new

government report shows the futility of his calls

for ever-more wealth redistribution.

Income Gap: As President Obama laments

America's growing income inequality, a new

government report shows the futility of his calls

for ever-more wealth redistribution.

To deflect attention from ObamaCare's failures, the president this month trotted out his income inequality chestnut. "A dangerous and growing inequality," he intoned, "has jeopardized middle-class America's basic bargain."

He argued, "as a trickle-down ideology became more prominent, taxes were slashed for the wealthiest, while investments in things that make us all richer, like schools and infrastructure, were allowed to wither."

Apparently, nobody bothered to brief the president before he delivered this speech. Fact is, federal transportation spending has climbed 39% in real terms since 1980, and spending on education has more than doubled.

And while Obama claims taxes were "slashed for the wealthiest," the average tax rate among the top 1% was higher in 2010 than in the early 1980s.

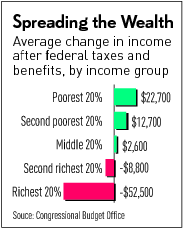

Meanwhile, a new Congressional Budget Office report shows that the government is already a massive wealth redistribution machine.

The CBO study breaks down the country by income into five equal groups, or quintiles. It found the top 40% paid more than 100% of all the income taxes, while the bottom 40% had a negative income tax. These families got more money through various refundable tax credits, on average, than they paid in income taxes.

Even when you include payroll and other federal taxes, the poorest group paid just 0.4% of all federal taxes, while the wealthiest paid 70%.

And this doesn't include transfer programs like food stamps, disability, welfare, Medicaid, Medicare and Social Security. These too are heavily tilted to the poor.

All together, the CBO found that families in the lowest income group earned an average of $8,100 on their own. But they received an average of $22,700 through federal transfer programs, net of taxes. In other words, the federal government more than tripled their income.

The next income group netted more than $12,000, on average, from government — a 41% boost to income.

At the top of the income scale? On balance, the government took 22% of income earned by families in the top income group, and 10% of the second-wealthiest group.

And this before Obama's new tax hikes on the rich, including ObamaCare. The result: weak economic growth, an anemic job market, stagnant wages, rising poverty, less upward mobility and growing inequality.

Want more opportunity and upward mobility? Pro-growth policies will work infinitely better than still more wealth redistribution.