China's Stocks Keep Falling Because of Government's Inept Meddling

IBDEditorials.com

Free Markets: Despite the government's best efforts at manipulation, stocks continue to plunge in China. Maybe it's time for the country's rulers to understand that they, not the market, are the problem.

Certainly China's managers have left little undone in trying to stanch the bleeding on its major exchanges. Two devaluations, interest rate cuts, a $200 billion infrastructure spending plan and outright purchases of shares by the People's Bank — nothing has halted the stock sell-off.

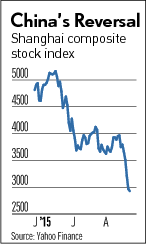

Since peaking on June 12, shares of the bellwether Shanghai Composite Index have plunged from 5166.35 to 2927.29, a brutal 43% decline. Nearly $5 trillion in wealth is gone. And it triggered a global slide.

As usual, the IMF has it all wrong. "It's totally premature to speak of a crisis in China," said Carlo Cottarelli, IMF executive director. "China's real economy is slowing, but it's perfectly natural this should happen. ... What happened in recent days is a shock on financial markets, which is natural."

Natural? China's government has manhandled its economy, believing it could force up stock prices, make the economy boom again and fill all those empty Ghost Cities and unused infrastructure projects by issuing more debt for "stimulus" programs.

The delusional IMF also believes China will grow 6.8% this year, down from 7.4% in 2014. It'll be lucky to grow at half that rate. Fact is, China is in crisis — a deep political and economic crisis of its own doing and as manifested by the ongoing stock market collapse.

Far from needing more bootless intervention by Beijing's Marxist-mandarin class, China's markets and economy require rational, free-enterprise policies.

For years, investors believed that China was on the road to greater freedom for its markets and its citizens. That's why they invested there. But Chinese leader Xi Jinping looks like just another clueless bureaucrat.

"For the first time in 35 years," the Heritage Foundation's William Wilson notes, "the world has finally come to the conclusion that state-led capitalism in China is no longer a valid model."

China's "model" is based on endless debt issuance, mercantilist trade policies, top-down industrial direction from Beijing and a forced 40% savings rate.

But if China prizes financial, political and social stability, it will privatize government businesses, stop printing debt, end its currency manipulations, open its markets to more trade and investment, and stop treating its people like mere property of the state.

China won't see 10% economic growth again. But it

can have stability. After watching its market plunge

for weeks, that might be the best it can hope for.