By John Merline

IBDEditorials.com

President Obama often talks about the need for a "balanced" approach to deficit reduction, by which he means tax hikes in addition to spending cuts.

At the recent presidential debate, for example, he said, "We've got to reduce our deficit, but we've got to do it in a balanced way — asking the wealthy to pay a little bit more along with cuts."

The only problem with this approach is that the massive projected deficits over the next 10 years aren't the result of too few taxes. They are entirely the result of too much spending.

Here's the proof.

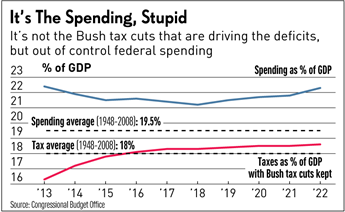

According to the latest budget forecast from the Congressional Budget Office, even if every expiring tax cut were kept in place permanently — including all the Bush tax cuts and various other expiring cuts from last year and this year — and even if the alternative minimum tax were permanently indexed to inflation, federal revenues would still rise to 18.6% of GDP by 2022.

To put that figure in perspective, from 1948 and 2008, federal revenues averaged 18% of GDP.

What's more, despite countless changes to the tax code — which included raising the top rate to 90%, then lowering it to 28%, then raising and lowering it again — revenues as a share of GDP have rarely deviated much from that average.

So even if all the Bush tax cuts were made permanent, federal taxes would end up slightly higher as a share of GDP than the historic average.

Spending Ramping Up

The CBO report also makes clear that it's out-of-control federal spending that's driving the deficits.

According to that report, the federal spending as a share of GDP is on track to steadily rise over the next decade and beyond, reaching 22.3% of GDP by 2022.

That's significantly higher than the 1948-2008 average and much higher than it's been under previous Democratic presidents. In President Clinton's last year in office, for example, federal spending consumed just 18.2% of GDP.

Yet while the president talks about cutting spending as part of a balanced plan, his budget would actually accelerate this spending trend, adding $1.1 trillion to the pile over the next decade, according to the CBO. By 2022, federal outlays under Obama's budget would equal almost 23% of GDP.

As a result, even though Obama wants to raise taxes as a share of GDP to historically high levels, his plan would still produce $6.4 trillion in deficits over the next decade.

Romney wants to cut the budget to reduce the

deficit. Obama wants to raise taxes on the

wealthy as spending accelerates. AP

View Enlarged Image

So what if, instead, federal spending were held to 20% of GDP, which is the goal set by Mitt Romney? In that case, you could keep all the Bush tax cuts in place and still produce deficits half the size of Obama's.

That approach would also be more in sync with what the public has repeatedly told pollsters it wants.

Smaller Government Favored

A Rasmussen poll taken in May, for example, found that 64% preferred smaller government and lower taxes. And a July IBD/TIPP poll found that just 38% favored "a bigger government providing more services."

The only real question is how to bring federal spending back in line.

As it stands, entitlement programs — Medicare, Medicaid, Social Security and others — are growing faster than the economy, which means that, left on autopilot, the federal government will chew up an increasing share of the economy year after year.

The problem is Democrats will fiercely attack any proposed changes to these programs.

ObamaCare cuts $716 billion in proposed Medicare spending, but uses that to pay for new spending on subsidized insurance exchanges and other parts of the law.

If entitlement growth isn't checked, then discretionary programs — which include such things as education, highways, justice, the environment and national defense — would have to be cut more deeply. Yet here, too, special-interest groups fight any cutbacks, no matter how small.

The bottom line is that unless lawmakers want to force taxes up to levels never before seen in the U.S., they have no choice but to get serious about cutting federal spending back down to size.