A Rate Which Lives In Infamy

Fiscal Policy: President Calvin Coolidge famously said that the chief business of the American people is business. Now it seems that the chief business of Congress is to make sure American businesses are taxed at a punitive rate.

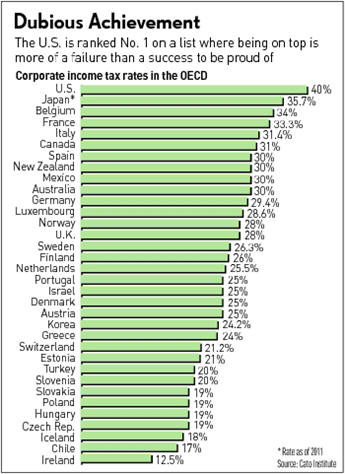

Earlier this week, Japan quietly announced it was cutting its corporate tax rate by 5 percentage points next year. That will leave the U.S., where the average combined federal and state corporate rate is 40%, with the highest rate in the developed world (see chart).

A high corporate tax rate is a drag on an economy. It affects a country's competitiveness as the steep rates chase away investment. Why pour capital into a factory or tech business in the U.S. when you could build either one in South Korea, where the corporate tax rate is nearly 40% lower and the work force is just as educated, skilled and motivated, if not more so?

Research confirms that high corporate rates have a direct negative impact on economic health. Scholars Young Lee and Roger Gordon found "that increases in corporate tax rates lead to lower future growth rates within countries."

According to the Tax Foundation, Lee and Gordon's findings indicate that cutting the combined average corporate from 40% to 30% — which would still be among the highest rates in Organization for Economic Cooperation and Development countries — "could boost U.S. economic growth by around 1.1% per year — enough to double our nation's wealth every 63 years."

Taking the federal rate alone down to 25% would create an average of 531,000 private-sector jobs a year from 2011 to 2020; boost GDP by an average of $132 billion per year; increase a typical family of four's after-tax income on average by $2,484 annually; expand U.S. capital stock by an additional $240 billion a year; and raise gross private domestic investment by $57.2 billion a year.

Karen Campbell and John Ligon, whose research for the Heritage Foundation yielded these numbers, say the 25% rate "would also increase the real after-tax profits of corporations by $124 billion on average per year."

American households would share in those profits through higher stock prices and dividend payouts.

The overall economic impact generated by the lower rates, write Campbell and Ligon, would add "an average $1.4 trillion per year more of net wealth."

There are no good reasons to keep today's corporate rate. Yet we can't even trim it no matter who sits in the White House or owns the majority in Congress. The rate has stayed stubbornly high for more than a decade.

Maybe in this era of apparent cooperation on taxes, Washington will address the situation in 2011. A cut in the corporate rate would be a good bookend to legislation making the current income tax rates permanent.